The effects of the pandemic have been felt in every industry. Is recovery in sight for the the global electric vehicle (EV) market?

The effects of the pandemic have been felt in every industry. Is recovery in sight for the the global electric vehicle (EV) market?

Unsurprisingly, the effects of the current global public health pandemic have been felt in every industry. However, the questions for many extend not only to “How bad will it get?” but also, “When will we rebound?”

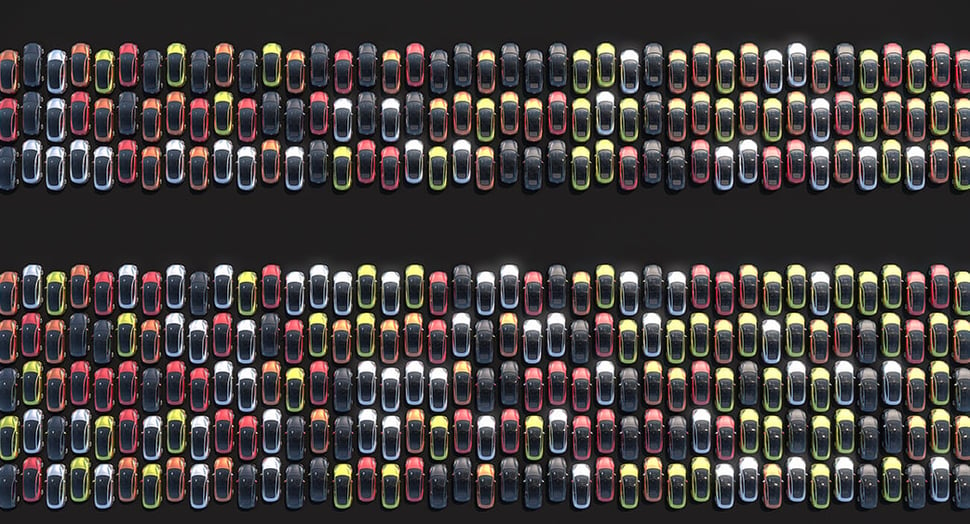

Taking a look at the global electric vehicle (EV) market, many experts are pointing out that while there has been a downturn - and predictions for continued decreasing EV sales - a recovery may take place sooner than expected.

The current state of the EV market

An array of factors - including widespread quarantine and lockdown orders, interruptions to well-established supply chains, as well as a worldwide recession - are impacting every industry, including that of the EV market, GreenTechMedia pointed out. Additionally, other elements unique to the EV sector are also having an effect, including the largest drop in oil prices ever seen.

As a result, the EV market has experienced an unsurprising decline in the face of the COVID-19 pandemic. As GreenTechMedia reported, this drop in EV sales is being seen on a global scale:

- The U.S. saw a 50% decrease in EV sales in April 2020, compared to the same period last year.

- China - which currently boasts the largest EV market in the world - reported a 60% drop in EV sales.

- Predictions for global EV sales aren’t faring much better. Bloomberg New Energy Finance (BNEF) forecasted an 18% decline in global EV sales this year, whereas consulting firm Wood Mackenzie expects sales to drop by 43% by the end of 2020.

While the EV sales are shrinking due to the current pandemic, the IEA’s Global EV Outlook 2020 noted that the overall passenger car market will be hit harder.

“The COVID-19 pandemic will affect global electric vehicle markets, although to a lesser extent than it will the overall passenger car market,” IEA’s Outlook report stated. “Based on car sales data during January to April 2020, our current estimate is that the passenger car market will contract by 15% over the year relative to 2019, while electric sales for passenger and commercial light-duty vehicles will remain broadly at 2019 levels.”

Recovery in sight?

Despite these dips in sales numbers, many experts are optimistic about the future of the EV market.

In fact, the EV market in Europe is already seeing growth. According to InsideEVs, European sales of EVs increased 23% year-over-year in May, resulting in more than 46,000 new electric vehicles being registered in the country.

“In other words, April was a one-off month with a negative result (16% year-over-year), caused by COVID-19, and the only negative month in almost 3.5 years,” InsideEVs pointed out.

This growth follows a significant first quarter in Europe’s EV market, which saw a more than 81% increase, year-over-year, during Q1 2020.

However, many experts, including James Chen, vice president of American EV manufacturer Rivian, believe the U.S. EV market won’t rebound as quickly, and that new policies are needed to coax more immediate growth. This is especially pertinent, as the current administration decided against extending tax credits for purchases of EVs.

“I don’t think, as a matter of public policy, the United States has really gotten behind electrification and EVs,” Chen noted. “And we need to change that.”

Overall, however, the EV market won’t remain down for long - BNEF predicted 60% of all new passenger car sales will be electric vehicles by 2040.

EV charging infrastructure expands

While the global EV market is experiencing a downturn, the IEA highlighted some positive news in its 2020 outlook: charging infrastructure for EV drivers is expanding.

Although most drivers still primarily charge their vehicles at home and at their workplaces, public charging stations are on the rise. Of the publicly accessible slow chargers available across the globe, 11% of these stations were in the U.S. in 2019, as well as 5% of all public fast chargers. Although China leads the charge in public chargers, expanding charging infrastructure is beneficial for the global EV market.

To find out more about home or business charging stations, check out our website and connect with us at Webasto today.